Money Management

Money management is how you make your money work for you, such as emergency funds (self-insurance), credit utilization, or investments. Organizing your money in a way that makes your life easier is vital to money management.

How to Get Started

Whether you just started making money, have been saving up your birthday gifts, or maybe you want to take control over your finance let's talk about money management. Money management is the most important color when it comes to financial literacy because without money management it is difficult to continue being successful in controlling your financial life.

This page will cover a few different things; first of all, how do you get studied with money management. Then it will cover why money management is so important when it comes to financial literacy. Lastly, We will dive a little bit deeper into different money management tips tricks, and resources that can make you a money master!

Let's start with the 7 baby steps. This formula was originally popularized by Dave Ramsey, in his book The Total Money Makeover, and covers the basic steps to be financially independent and how to manage your money properly. So let's go over the seven steps to money management and how they are important to you.

Save $1,000 - This may seem like a lofty goal, especially for those of us who are on the younger end of the spectrum, but it is one of the most important steps in getting your money under control. this first step to save $1,000 will function as your beginner’s emergency fund. An emergency fund is a form of self-insurance that is useful in cases where you have unexpected expenses. Examples of these expenses are: getting into an accident, getting sick having to go to a doctor's appointment, or getting a ticket. We can all agree these expenses are frustrating but an emergency fund makes them less so.

Pay off all of your debt - Before you get investing or spend money to your heart's content you need to pay off all of your debt. If you don't have any debt congratulations you can skip this step but if you so let's talk about what debt we are focusing on here. Cut that we are focusing on in this stop are things like credit card debt or personal loans. These forms of debt a crew quickly and can be very damaging to your financial future it is vital that you spend time breaking down your debt and how to pay it off. A type of debt that you can ignore during the step is something like student loan debt. Student loan debt is considered “good debt” and while it may not be good it usually has low-interest rates and is more reasonable to pay off in a long. Of time.

Save 3 to 6 months’ worth of income - Now that you have paid off all of your debt it's time to reinforce your emergency fund. While $1,000 is nice for small expenses, if you happen to be extremely sick and can't work, or you lose your job unexpectedly, it is good to insureYou can feed yourself and put a roof over your head for 3 to 6 months. This emergency fund should cover rent food and basic expenses over this time period and is meant to relieve stress over these hard times.

Invest 15% of your income - Investing can be different for everyone but in most cases, 15% of your income is a good starting point to invest in your future. This step is mostly to prepare you for retirement. By putting your money into an investment account like a 401k, if you are with a company that offers one, or an IRA you can guarantee a secure future when you retire.

Save for college - Saving for college in this specific circumstance does not mean saving for your college. It more so means saving for your children's College. It is never too early to start saving for your childhood education and by utilizing an account like a 529 or another sort of educational savings / investing account you can ensure that your kids’ college is paid for. Another option is saving for future education things like a master's degree or Ph.D. are expensive and it can be very beneficial to save for this further education.

Pay off your home - Paying off your home is a huge step in your financial future. this is something that many people strive to do throughout their entire life end is definitely a good goal to have. However, if you have a different lifestyle where you don't necessarily want to settle down in one place renting houses and using this extra money to build wealth is a totally valid option. These are all things to think about and you should take time trying to figure out what you want and whether or not you want to buy a home.

Build wealth and give - Now that you are a pro at money management and have all your ducks in a row it's time to sit back relax build wealth and give to those less fortunate. Building Wealth can be accumulating assets or spending time working after you are financially independent. As for forgiving, I believe it is important to share your success with those around you that you truly care about. This can be gifting your close family or friends a degree of financial freedom or donating your time to charity.

.png)

Why is this important?

So who cares? Why is Money Management important and why do I call it the most important aspect of financial literacy? Well, in brief, if you can't manage your money you can't do much else. Saving, investing, credit management, risk management, and more are all concepts that are based on money management. Well, it is true one can get a job and be successful without it the longevity of their Financial Security as well as the stress levels they will have to deal with are not reasonable compared to an individual with money management skills.

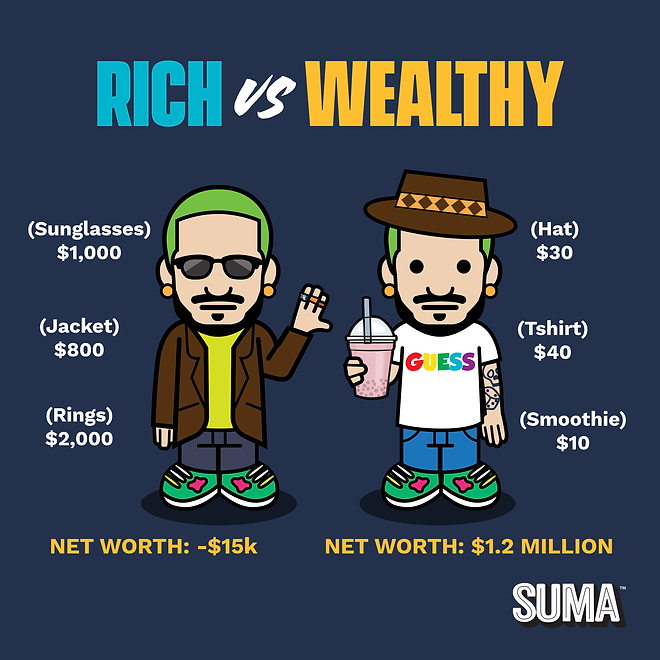

First things first let's differentiate between rich and wealthy. From there we can talk about why this is important and how money management differentiates those who make money and those who accumulate wealth. The understanding of these Concepts helps put money management into perspective and emphasize its importance.

What does it mean to be rich? The concept of being rich is one that is synonymous with celebrities and pro athletes. Being rich is the big diamond jewelry massive houses fancy cars and expensive dinners that are seen in Hollywood movies. While this life may be lavish and enticing it is not sustainable. One can only pay $1,000 for dinner so many times a year before they just run out of money. Do it is true that these fancy dinners and nice cars are not only reserved for the rich it is apparent that rich people end to flaunting their wealth more than those who are wealthy.

What does it mean to be wealthy? Most people use rich and wealthy interchangeably but in the world of personal finance, there is a distinguishable difference. Wealthy people accumulate money rich people spend it. Picture 2 people making a six-figure salary one can be rich in the other can be wealthy the only difference is 20 years down the line when they both want to retire one can continue their exact same lifestyle after retirement and the other has to severely downsize their spending or worked themselves into the ground.

This conversation is not meant to be bleak but it does shine a spotlight on the importance of money management. In order to be financially literate and to relieve financial stress, you have to aim to be wealthy, not rich.

Diving Deeper

Now you may understand the importance of money management and aim for a wealthy life rather than a rich one but how do you get there? How can you actively change your habits in order to be a more financially literate individual? It starts with recognition and understanding. Maybe you are young and all you've done with the money from your job is buy clothes and food. Maybe you just got your first major job and decided to buy a new laptop a nice watch and other unnecessary material Goods. This is okay because enjoying your life and your possessions is totally fine; however, It is important to set boundaries for yourself in order to get into better habits of money management.

Actively set goals that fit with your wealthy mindset and follow the 7 baby steps before it is too late. Remember when it comes to financial literacy time is on your side so for those of you who are young start saving now and don't wait for the future. And for those of you who are older, I give the same advice because the longer you wait the more you will regret not implementing a money management system into your life. All these systems can do is help so take the time and the energy to make your life easier

One of the best ways to implement money management strategies in your day-to-day life is using apps things like You Need a Budget (YNAB) or Intuit Mint Are both great options for visualizing and understanding money management. The software's booth also contributes to savings and investing however as I previously stated money management is the overarching financial principle that, once mastered, will make your life easier no matter the scenario. For more information about money management applications or resources